On January 29, 2009, Gov. Pat Quinn inherited a state budget that was in dire straits. The budget deficit grew daily due to the economic consequences of the Great Recession, when thousands of Illinoisans lost their jobs and their homes.

During his time as Governor, Pat Quinn signed six state budgets into law, cutting state spending by more than $5 billion while providing sufficient revenue for vital public services such as education, healthcare, public safety, and human services.

On January 13, 2011, Gov. Quinn signed legislation (Public Act 96-1496) to impose comprehensive state spending caps and enable Illinois to have sufficient revenue for education, healthcare, public safety, human services, and actuarially-required pension funding for state employees and teachers.

View the Governor’s Office Press Release of Quinn Holding Press Availability on New Legislation.

View the Governor’s Office Press Release of Quinn Announcing State's Backlog of Bills Falls to $3.9 Billion .

View the Governor’s Office Press Release of Quinn Delivering Fiscal Year 2015 Budget and Five-Year Blueprint to Secure Illinois’ Financial Future.

View Governor Quinn's Budget Address.

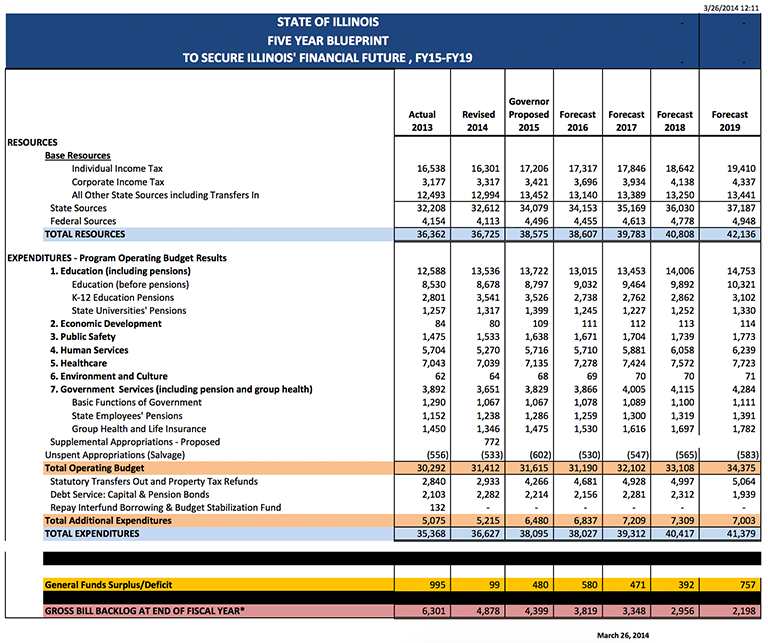

In his 2014 Budget Address, Gov. Quinn proposed this five year blueprint (2015 to 2019) to secure Illinois’ finances for the long term:

In early 2014, Gov. Quinn suggested to the Speaker of the House a 3% income tax surcharge on the state’s millionaires to provide more funding for education. On July 29, 2014, Gov. Quinn signed legislation for an advisory referendum asking voters if they favor an income tax surcharge on the state’s millionaires in order to provide much-needed funding for public education in classrooms across Illinois.

The question read as follows: “Should the Illinois Constitution be amended to require that each school district receive additional revenue, based on their number of students, from an additional 3% tax on income greater than one million dollars?”

On July 29, 2014, Gov. Quinn signed legislation for an advisory referendum asking voters if they favor an income tax surcharge on the state’s millionaires in order to provide much-needed funding for public education in classrooms across Illinois.

View the Governor’s Office Press Release of Quinn Signing Legislation to Give Public a Voice Regarding Millionaire Tax for Classroom Education.

On November 4, 2014, Illinois voters approved the advisory referendum question with 63.6% (2,200,033 votes to 1,256,642 votes).

View the Governor’s Office Press Release of Quinn Signing Legislation to Limit Elected Officials’ Compensation .

View the Governor’s Office Press Release of Quinn Announcing Best Contract for Taxpayers in Illinois History.

View the Governor’s Office Press Release of Quinn Signing Historic Illinois Public Pension Reform Bill.

View the Governor’s Office Press Release of Quinn Commending Budgeting for Results Commission on Reform Recommendations.